In January, the House Judiciary Committee sounded the alarm about the federal government asking banks to surveil transactions related to certain keywords, such as “MAGA” and “Trump,” as part of investigations into January 6, 2021 at the Capitol. But new documents obtained by the House Judiciary Select Subcommittee on the Weaponization of the Federal Government have revealed that the surveillance that was initially identified by the House Judiciary Committee in January was much broader than these early reports suggested.

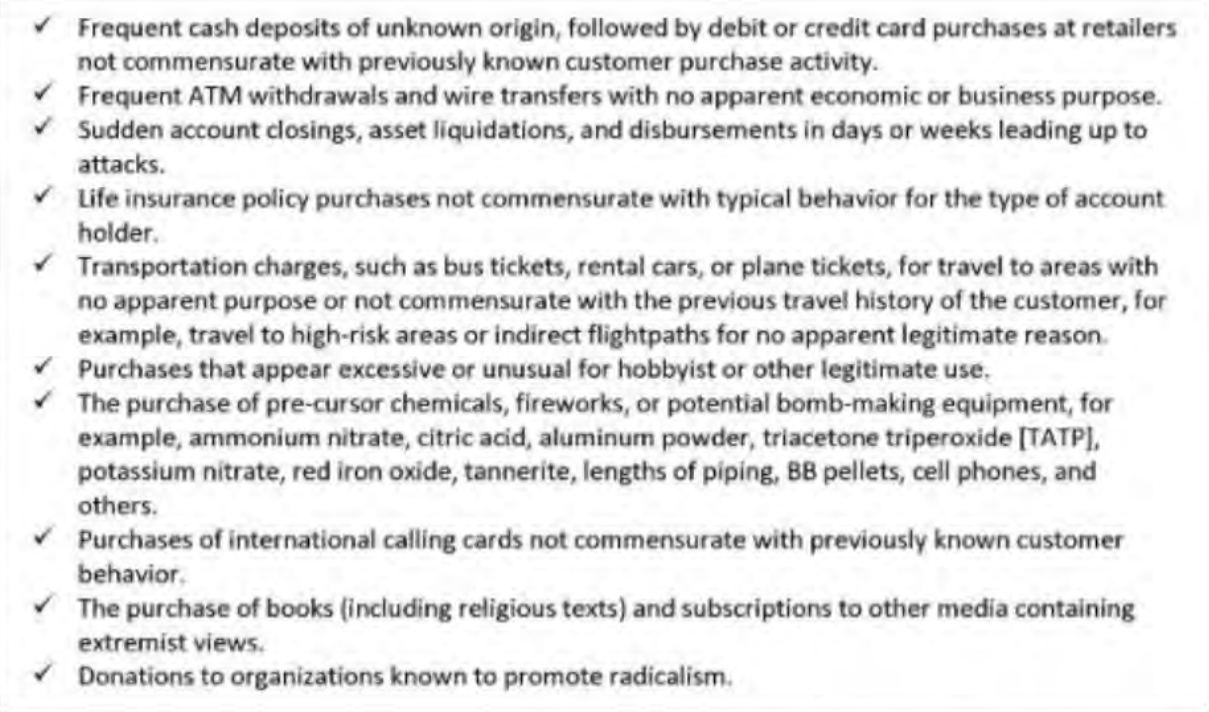

The House Judiciary Committee’s initial letter about this financial surveillance revealed that the Financial Crimes Enforcement Network (FinCEN) sent several financial institutions lists of terms that it deemed to be indicators of potential violent extremism and suggested that banks use these search terms to flag suspect transactions. These lists included terms such as MAGA and Trump and also recommended searching for more generic terms, such as terms related to purchases of transportation and terms related to purchases of books (including religious texts) and other media that FinCEN deemed to be “extremist.”

These new documents, which were shared in a report titled “Financial Surveillance in the United States: How Federal Law Enforcement Commandeered Financial Institutions to Spy on Americans,” show that the list of terms FinCEN asked banks and financial institutions to flag was much wider.

In one document, FinCEN brands lawful activities, such as “frequent ATM withdrawals and wire transfers with no apparent economic or business purpose” and “purchases that appear excessive or unusual for hobbyist or other legitimate use,” as potential indicators of violent extremism.

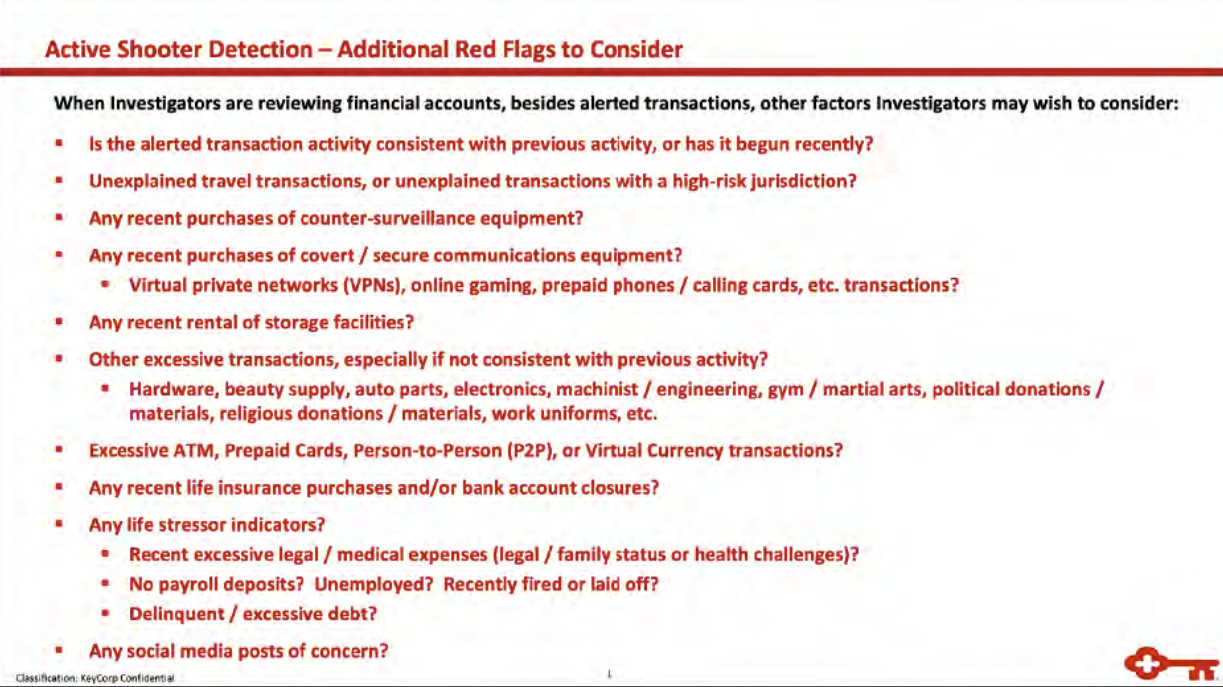

In another document, FinCEN brands purchases of privacy-preserving tools, such as virtual private networks (VPNs), “counter-surveillance equipment,” or “secure communications equipment,” as potential “red flags” for “active shooter detection.”

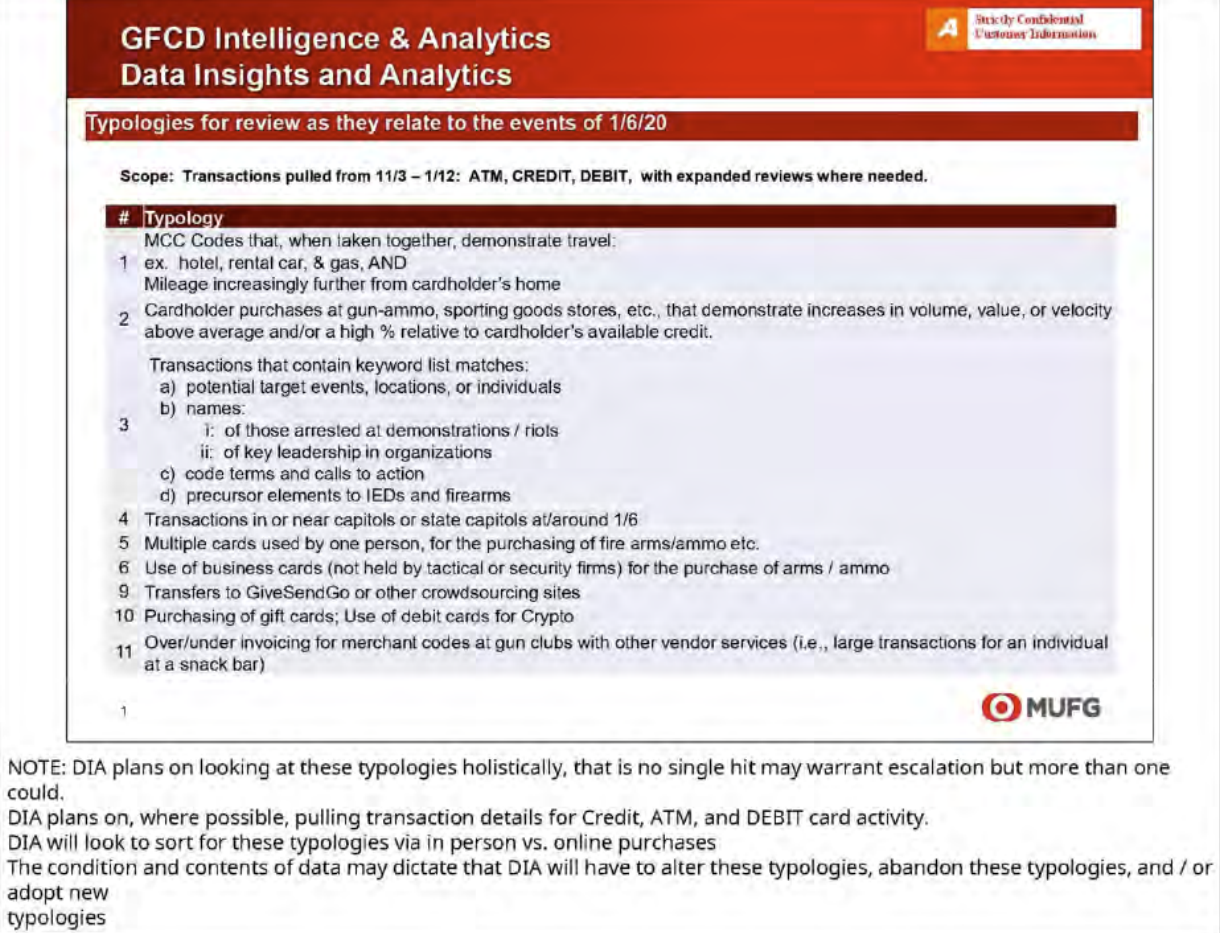

And in another document, FinCEN describes purchases of gift cards, “transfers to GiveSendGo or other crowdsourcing sites,” and “use of debit cards for Crypto” between November 3, 2020 and January 12, 2021, as “subjects of interest” for January 6 investigations.

In addition to revealing the vast scope of FinCEN’s financial surveillance dragnet, this report also revealed that FinCEN sent financial institutions links to the Anti-Defamation League’s (ADL’s) lists of “hate symbols” and a link to the Institute for Strategic Dialogue’s (ISD’s) report on “funding of American hate groups.” FinCEN described these as links to “key terms applicable to matters related to racially and ethnically motivated violent extremism, which may have application to the Capitol riots and related activity.”

The ADL’s hate symbols list has been criticized for including fake hate symbols and the report notes that anti-Antifa images, and the Okay Hand Gesture are some of the contentious examples of what the ADL deems to be hate symbols.

Meanwhile, the ISD, a UK think tank that receives State Department funding, has faced criticism for its involvement in the censorship of Americans. The report notes that the ISD has incorrectly characterized several conservative groups as “hate groups.”

Another revelation from the report is that the FBI shared intelligence products with financial institutions via a web portal that was operated by the Domestic Security Alliance Council — a public-private partnership led by the FBI’s Office of Private Sector and the Department of Homeland Security’s (DHS) Office of Intelligence and Analysis.

The report also reveals that since January 6, FinCEN and the Federal Bureau of Investigation (FBI) have held multiple discussions with many of America’s biggest banks as part of an attempt to get them to “voluntarily” share customer data with federal law enforcement agencies “outside of normal legal processes.” According to the report, some of the banks and financial institutions that these discussions were held with included Barclays, U.S. Bank, Charles Schwab, HSBC, Bank of America, PayPal, KeyBank, Standard Chartered, Western Union, Wells Fargo, Citibank, Santander, JPMorgan Chase, and MUFG.

The report claimed that the financial surveillance that the subcommittee uncovered was “aimed at millions of Americans.”

While the January 6 Capitol investigation was used by federal investigators as a pretext for this financial surveillance, a source with knowledge of the documents told Fox News Digital that the government has used the information for investigations extending beyond January 6.

You can read the full report here.

In a hearing examining this Big Government-Big Bank financial surveillance collusion, Subcommittee Chairman Rep. Jim Jordan (R-OH) branded the surveillance as “Orwellian” and “scary.”